by Jeff Pittman | Jan 21, 2016 | Real Estate News

2016 Predictions What’s In The Cards For Southern California Real Estate? We remembered lessons learned from last year and discussed how we could apply them to the Southern California market this year. So the question is – what exactly does 2016 have in store for us in real estate? We decided to poll our agents and get their expertise on just what they predict is coming to the SoCal real estate market. The experts are divided on some points but on others, nearly everyone is seeing eye to eye. Take a look at what we think is in the cards for Southern California real estate. WHERE ARE MORTGAGE RATES HEADED? 87%: RATES ARE GOING UP 13%: NO CHANGE If you follow our Weekly Mortgage Watch, then you know rates have remained level for the past few months, hanging out at historic lows under 4%. In December the Feds promised a “liftoff” of rates but luckily mortgage rates have still remained steady across the spectrum. The question is now, for how long? David Mier, Assistant Manager of our Yorba Linda office, says “The Feds have indicated that they predict three separate 1/4% rate increase for 2016.” Marcel Atallah, Temecula office manager, also predicts rates heading up. “They have too. [Rates] are artificially low and I believe we will see them bump up, but not too crazy, due to the election year.” WHERE ARE HOME PRICES HEADED? 40%: PRICES ARE GOING UP 40%: PRICES ARE HEADED DOWN 20%: NO CHANGE Our experts are split on whether or not home prices will rise or drop, and looking at the sold prices for 2015...

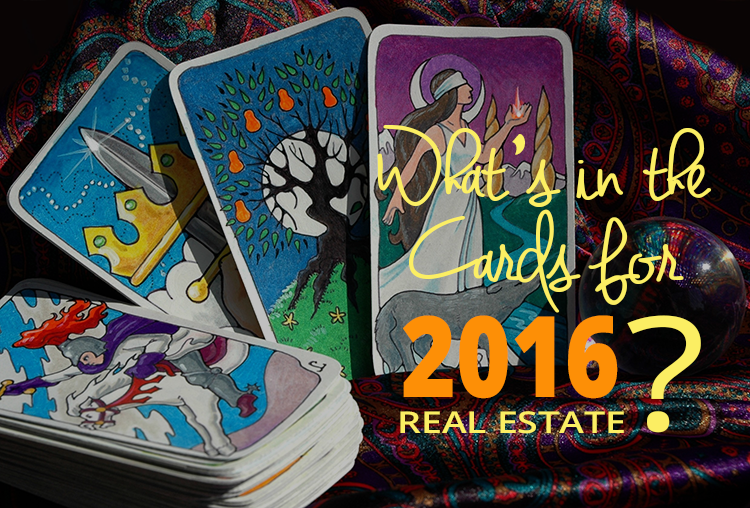

by Jeff Pittman | Mar 30, 2015 | Real Estate News

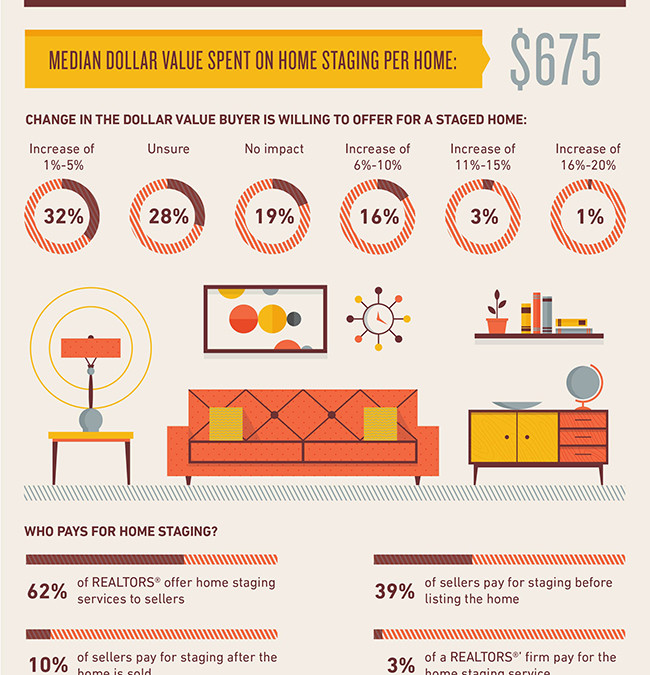

According to the 2015 Profile of Home Staging from the National Association of REALTORS®, homebuyers put forward bigger offers when it comes to staged homes. CAR breaks down the financial benefits in their Infographic on why buyers offer more for a staged home. Via First Team Real Estate. Thank you for reading. I hope you found this information useful. Jeff Pittman, Realtor in Ladera Ranch – Orange County,...

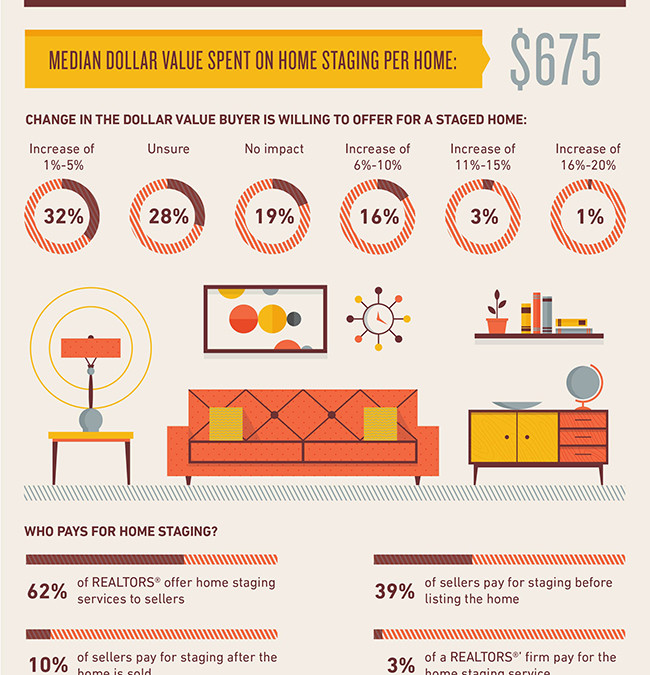

by Jeff Pittman | Jan 30, 2015 | Real Estate News

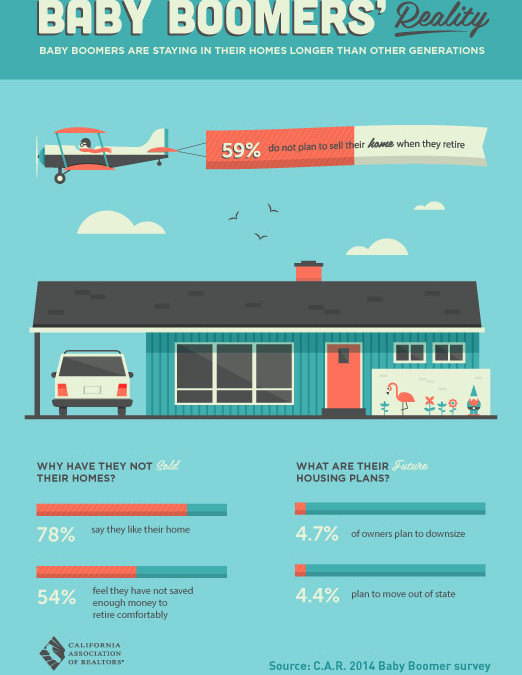

The expected flow of the real estate market goes something like this: First-time buyers enter the market in starter homes, the generation in starter homes moves up into larger houses and those at retirement age move to downsize. Baby Boomers (born between 1946-1964) are nearing retirement age however it seems the reality is, they’re not following the expected progression of buying and selling. Baby Boomers’ Reality – Baby Boomers are staying in their homes longer than other generations and 59% do not plan to sell their home when they retire. Via First Team Real Estate. Thank you for reading. I hope you found this information useful. Jeff Pittman, Realtor in Ladera Ranch – Orange County,...

by Jeff Pittman | Oct 20, 2014 | Real Estate News

According to the USC Casden Forecast for 2014, rents across Southern California will continue to rise over the next two years with project growth of 8.6% in Orange County.Vacancy rates have been decreasing in LA, Orange County, the Inland Empire and San Diego for the past year so it’s no surprise that they will continue to rise over the next two years.USC cites the recovering economy as one of the reasons for the rise in prices. This year the California economy has maintained strong momentum; unemployment fell 8.5 percent from last year, and the state’s GDP rose 2% in 2013.However, though the economy is improving, renters’ incomes are at a stand still. While occupancy rates are moving in the right directions, affordability is worsening. Here’s a breakdown of projected rent increases by mid-2016: LA County – 8.2% rise to an average rent of $1,856 a month Orange County – 8.6% rise to an average rent of $1,806 a month Inland Empire – 9.9% rise to an average rent of $1,246 a month Click here to download 2014 USC Casden Multifamly Forecast Start Reviewing Your Options So what can you do to combat the rising rent? Nothing. But you can start saving for a home of your own because the facts are this: mortgage payments may be cheaper than your rent. Knowing the market and your options is critical to making the smartest financial decision for your future. Before rents start rising – and interest rates too – let’s review your options. 20331 Bluffside Circle Unit 207 is a studio apartment located in Huntington Beach just down the street from the sand, the HB...

by Jeff Pittman | Sep 16, 2014 | Buyers, Real Estate News

If you’ve been through a short sale or foreclosure and are looking to get into another home, it’s the type of loan you get that determines how long you have to wait. Educate yourself and check out our quick breakdown of the wait periods after both short sales and foreclosures based on the type of loan you secure. Are you eligible for the reduced wait period? Defining extenuating circumstances For the Fannie Mae and Freddie Mac loans there are reduced wait periods available under extenuating circumstances for foreclosures and short sales. What are these extenuating circumstances? Well there are a few but they’re more restrictive than you’d think. If you had a loss of job or a loss in the family you might be eligible. However things like divorce and general financial hardship do not apply. To be eligible for the reduced wait period you must also have AUS (automated underwriting services) approval and a max LTV of 90%. Each loan has a specific LTV which specifies the percent of the home value a lender will lend to you as a borrower. For example with a 90% LTV loan on a home priced at $600,000, you could borrow up to $540,000 which is a requirement of at least 10% down payment. Calculating your specific wait period: Fannie Mae Foreclosure: Calculated from the date the title was transferred out your name (the borrower) to the date the credit report is pulled on the new transaction. Short Sale: Calculated from the date of competition of the short sale to the date credit report was pulled on new transaction. Freddie Mac Foreclosure: Calculated from the...

by Jeff Pittman | Jul 3, 2014 | Buyers, Real Estate News

We all have real estate crushes. What’s on your short list of deal...