by Jeff Pittman | Sep 21, 2015 | Buyers

5 Obstacles Millennials Face When Buying A Home It’s no surprise that there are obstacles standing in the way of homeownership, but there is good news – according to recent survey from Carrington Mortgage Services over half of millennials still plan to buy a home in the next two years. Here are the top 5 obstacles millennials face when trying to buy a home so you know what to look out for yourself. Via First Team Real Estate. Thank you for reading. I hope you found this information useful. Jeff Pittman, Realtor in Ladera Ranch – Orange County,...

by Jeff Pittman | Sep 10, 2015 | Buyers

Are You Prepped and Ready For A Second Home? Could it be time to invest your hard earned money into a second home and the real estate market? The potential income from a second property is a profitable solution on the housing market that you could benefit from. You would do well, however you have to consider whether you are really ready for it. Having a vacation home or a new investment property is an excellent way to expand your existing real estate portfolio. However, before you decide, you should look at the facts and prepare for the responsibility a second home brings. ARE YOU READY TO COMMIT YOURSELF TO THE TASK? Consider whether you’re ready to take on the maintenance and tasks of a second home and or whether you would be better off renting a vacation home rather than being a landlord yourself. There are a lot of things you will need to take care of in terms of prepping a home and maintaining the property throughout the year. Plus if you are the owner and renting it out, there’s even more work to be done dealing with renters and legal matters. If you decide you do want to own and take on the responsibilities, companies like our First Team Property Management division can help with the upkeep and renters. CONSIDER THE FINANCIAL IMPACT Just because you have money for a property that doesn’t automatically mean you will be successful in finding what you need right away. You would do well to consider the long-term financial impact on you and your wallet for maintaining a new property...

by Jeff Pittman | Jul 7, 2015 | Buyers

4 Renovation Tips For New Landlords If you happen to be new to real estate investment, then you will likely feel excited when you end up closing escrow on the first purchase you make. It’s a powerful feeling, making headway on your new career, but there are many ways you can improve your abilities and presence on the market – if you know what you’re doing. There is a lot of hard work involved in being an exceptionally good real estate investor, as you will soon find out, especially when you need to renovate a new investment property. The following tips will give you more information on making it work and how you can improve what you already own: BUDGETING OF TIME AND MONEY When closing time comes around, you will likely have a list of improvements you may have in mind, but you will need to place those in a suitable budget. Repairs will also need to be completed within a month’s time if you want to be able to rent the property out and generate profits without losing your momentum on the market. Once you realize that most improvements will be quite costly, chances are you will need to revise your budget and let some of your ideas go. Be careful in such cases and do your best to do so when you estimate a low-price and quick renovation. AVOID TAKING THE FIRST BID You need to check out several bids to ensure you get a fair price for your contracting work that needs doing. The more expensive the job that needs doing, the more bids you...

by Jeff Pittman | Jun 8, 2015 | Buyers

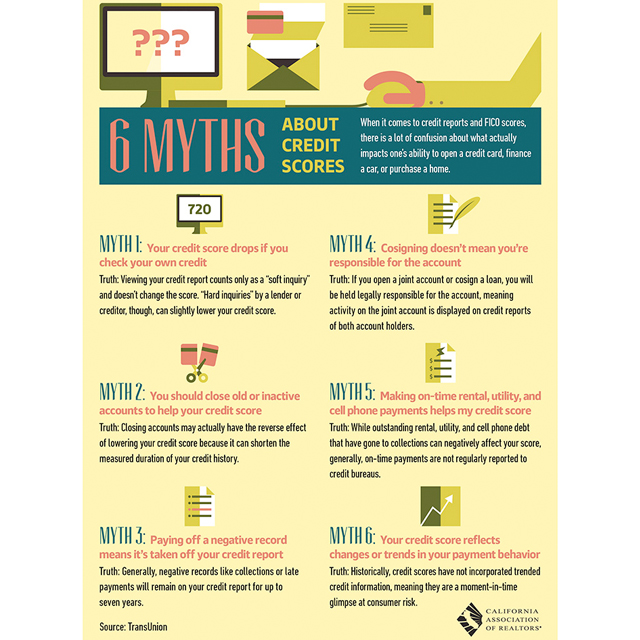

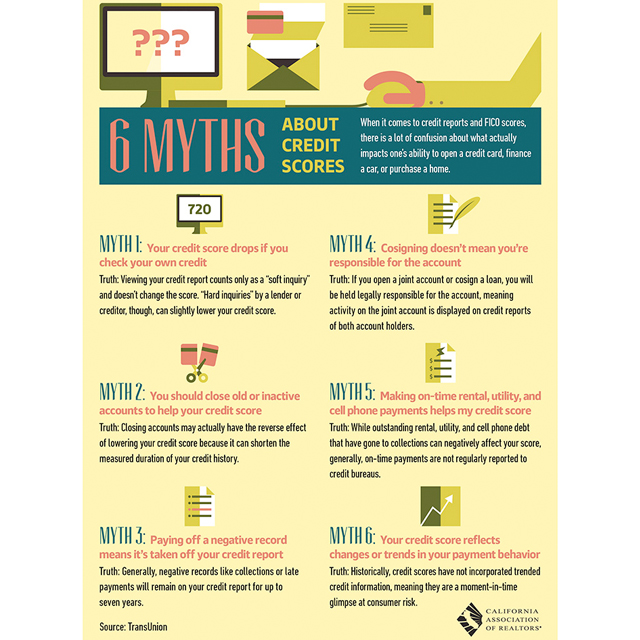

6 Myths About Credit Scores That Need Debunking The latest Infographic from California Association of REALTORS breaks down 6 myths about credit scores that need some serious light shed on them. If you’re buying a home and trying to secure a mortgage loan, these are the basics you need to understand to ensure your score – and your subsequent loan – is the best it can be. Via First Team Real Estate. Thank you for reading. I hope you found this information useful. Jeff Pittman, Realtor in Ladera Ranch – Orange County,...

by Jeff Pittman | Jun 1, 2015 | Buyers

3 Key Survival Tactics To Get You Through A Real Estate Bidding War The housing market this Spring is getting a competitive edge thanks to hot buyer demand and low inventory across Southern California where average sales prices are above average estimated market values of homes sold in April in our metro area. According to Mark Hughes, chief operating officer here at First Team, “Current market activity belies a seller’s market, a lot of activity, less inventory then those looking. We seemed to have reached close to equilibrium nationwide but the combination of a hot destination and cool metro areas [in Southern California] still skew toward sellers for now.” A First Team Real Estate agent working in Aliso Viejo, puts it frankly, “There’s no inventory, and there are a million buyers looking for property. A home comes on the market and it’s like a revolving door of buyers and agents.” According to Redfin 61% of offers written by their agents faced competition from other buyers in March. So the question is – how does a buyer survive a real estate bidding war? Redfin’s research showed that the most common feature in winning offers was a cover letter. There are plenty more tactics to use as well this summer on the SoCal real estate market and they all boil down to three survival strategies – Be ready, Be flexible and Don’t give up! #1 BE READY KNOW WHEN TO SEE A BIDDING WAR COMING Any city with a market time below one month – the time it would theoretically take to sell all houses in the MLS based on new escrows –...

by Jeff Pittman | May 18, 2015 | Buyers

5 Reasons Why Money Smart People Own Real Estate Andrew Carnegie, the wealthiest man in America during the early 20th century, once ruminated that “90 percent of all millionaires become so through owning real estate.” I’m not sure Carnegie had any big data to back up his stats but he makes a very good point – money smart people see the value of owning real estate. Here’s a bit of bid data however that does supports the rich entrepreneur: In the past 15 years, the net worth of the typical homeowner has ranged between 31 and 46 times that of the net worth of the typical renter. Data from the 2014 Federal Reserve Survey of Consumer Finances also shows that median homeowners had nearly $200,000 in net worth, 36 times that of the median renter who had just over $5,000. The median value of owners’ homes was just $170,000. Now that you’ve got the big picture, let’s break down 5 specific reasons why money smart people own real estate. Real Estate is the most commonly leveraged investment. When you have equity in your home, you can borrow against it. Few households are interested in borrowing money to buy stocks and bonds and few lenders are willing to lend them the money. As a result, homeownership allows households to amplify any appreciation on the value of their homes by a leverage factor. You’re already paying a mortgage. If you rent, you’re simply paying your landlord’s mortgage. If you buy your own home, your monthly check will go down to reducing your own principal. Why not pay down your own debt...