by Jeff Pittman | Aug 24, 2015 | The Market

What Is A Housing Bubble? Discussions of the past and possible future housing bubble have been all over the real estate news for a while now. We all know that the recession of 2007-2009 was caused primarily by a housing bubble that burst in 2008. But what exactly is a housing bubble? It’s not just a rise it prices. It’s a market condition created by excessive home buying that runs up prices based solely on the expectation that the prices will continue to rise. However, eventually homes become too overpriced for buyers to keep up, the bubble pops and housing prices plummet. Shaky lending practices are another factor that led to the financial crisis and the spike in prices during our last housing bubble. Crucial players in the bubble, lenders with poor underwriting standards helped unqualified buyers purchase home loans they couldn’t afford to pay back. Recently, some critics have been questioning whether the U.S. could return to a crisis like the one in 2008 because real estate values have been rising according to data from the National Association of Realtors®. The median existing single-family home price increased in 93% of markets with the national median existing single-family home price in the second quarter reaching $229,400, up 8.2% from the second quarter of 2014 ($212,000). SO, DO WE HAVE ANYTHING TO WORRY ABOUT? Not really according to Nick Timiroas at the Wall Street Journal. In a recent article on rising home prices, he explained that although median home prices this June hit a record high since 2006 at the peak of the bubble, he pointed out, all else equal,...

by Jeff Pittman | Apr 7, 2015 | The Market

What Is A Buyer’s vs Seller’s Market In Real Estate How do you define a buyer’s market vs. a seller’s market in real estate? The simple answer is that when there’s more supply than demand, it’s a buyer’s market and when there’s more demand than supply, it’s a seller’s market. Demand in is commonly judged by months of inventory based on closed sales. Buyer’s Market = 6 or more months of inventory Seller’s Market = Less than 3 months of inventory Neutral Market = 3-6 months of inventory So What Does Months of Inventory Mean? Months of inventory takes into account the number of homes for sale on the market with recently sold homes and reflects the number of months it would take to sell all homes currently on the market. You can calculate months of inventory by dividing the total number of homes for sale over the number of homes sold in one month. When months of inventory are low, it’s a fast paced market dominated by buyers and few sellers. When months of inventory are high, there are generally more homes on the market (dominated by sellers) with fewer buyers or sales. Currently SoCal is a Neutral Market According to Trendgraphix, there are 3.9 months of inventory across Orange, LA, San Bernardino and Riverside counties, qualifying our current SoCal real estate market as neutral. Inventory is making its way up however, up 2.6% from last month and 11.6% compared to last year. Riverside County has the most inventory, leading the pack with 5.3 months. Across all counties there was a spike from the beginning of the year, jumping area...

by Jeff Pittman | Jan 15, 2015 | The Market

We’re busy preparing for 2015 – analyzing the current market, getting a pulse on buyers and sellers in the market and building marketing strategies. So we decided to ask our agents for their insight on what to expect in our local markets for 2015. We love to share our market knowledge so here you will find Southern California Real Estate Predictions and Trends for 2015: Mortgage rates are likely to rise Home prices should remain stable The market will begin favoring buyers Pricing will be sellers #1 priority Keep a close eye on affordability Mortgage rates There is some debate as to whether mortgage rates will rise or fall this year, however the majority consensus is that rates will go up in 2015. The Federal Reserve has kept mortgage rates artificially low through quantitative easing – its program of monthly purchases of government and mortgage bonds to swell the size of bank reserves in the economy by the quantity of assets purchased. It is likely that as the economy picks up, the Fed will loosen its grip and allow rates to rise in order to offset inflation. Increasing interest rates has been the policy for bringing down inflation in the past and we predict could be a strategy used this year as well. Stable prices The majority of agents predict that there will be little to no change in home prices in 2015. The market is continuing to normalize and we’re expecting an appreciation rate of no more than 7%. Prices usually rise and fall with interest rates, however 2015 could be the exception. Some local areas that are in high...

by Jeff Pittman | Feb 5, 2014 | The Market

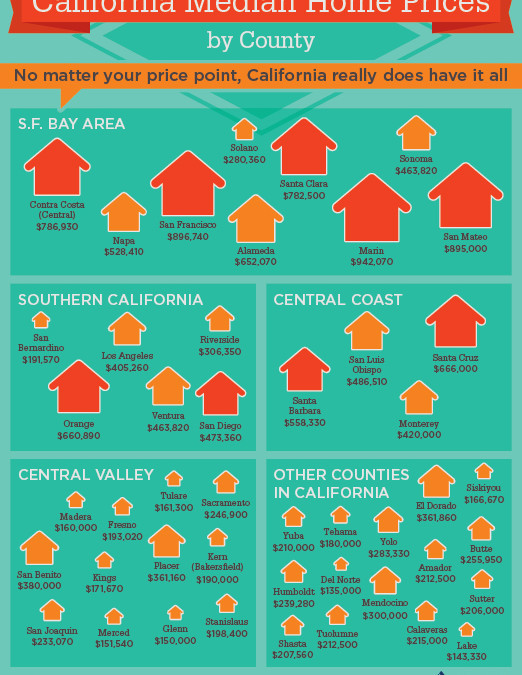

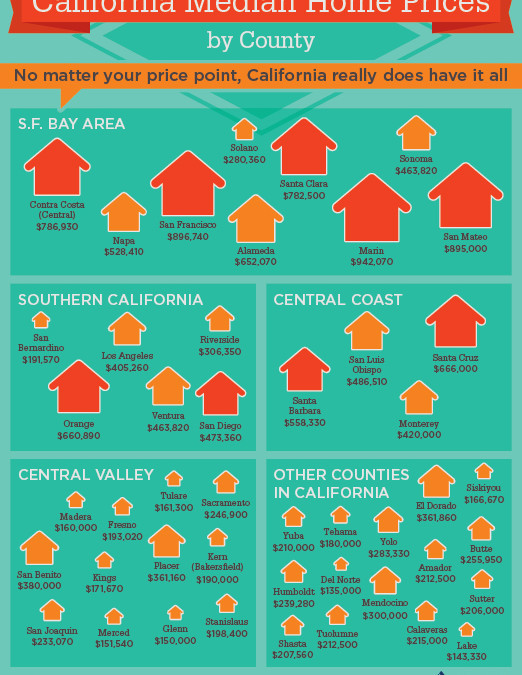

Here’s a breakdown of California home prices county by county. No matter your price point, California really does have it all!

by Jeff Pittman | Dec 3, 2013 | The Market

If you haven’t refinanced, my advice is please do! And if you are considering a real estate purchase – you will look back 3 years from now on a decision to do it today and you will know you were a brilliant investor. Related articles Reasons Why You Should Consider Refinancing Your Mortgage (ctebockhorst.wordpress.com) Mortgage Refinance Guide Helps Borrowers Make Informed Decisions (sacbee.com) Save Tens of Thousands on Your Mortgage Payments...

by Jeff Pittman | Nov 27, 2013 | The Market

If you believe that home values are on the rise, then the big money in real estate will be made in the next 4 years. So act now – there may never be a better time to buy real estate. What is your next real estate move? Related articles Revealed: New York’s Top 20 Real Estate Titans...